Feeling priced out? What the future has in store for Toronto real estate and why you shouldn’t give up yet.

GTA home prices have increased at a steeper rate throughout the last 15 years vs. prior decades fuelled by relatively low interest rates and demand that has out-paced supply:

Now, with interest rates having suddenly surged to levels not seen since PRIOR to this steep price growth period and prices having not declined to the same magnitude (average home prices in the GTA are only down 8% since average mortgage rates started rising in March 2022, which are now roughly 300% higher), we find ourselves experiencing record unaffordability:

A steep decline in the number of new listings, and subsequently the number of buy/sell transactions, have helped to keep prices high as demand outstrips the supply of available listings despite skyrocketing interest rates.

So, with housing now eating up an even more unfathomable percentage of our incomes, where does the market go from here?

Home prices will likely grow at a slower rate for the foreseeable future. But yes, GROW.

Fundamentally there is going to be strong demand so don’t bet on prices crashing. The population of the GTA is set to explode throughout the next 20 years, increasing by about 3 million (from 7M to 10M) due to immigration from other countries. Although recent provincial measures designed to increase density will contribute to add new supply, at the current clip we are building it’s going to be tough just to keep up with demand let alone build enough houses to improve affordability. Check out these charts if you care to see some sobering supply-side projections: https://www.cmhc-schl.gc.ca/en/blog/2022/canadas-housing-supply-shortage-restoring-affordability-2030

Interest rates will likely come down as soon as the Bank of Canada feels they are able to lower them, helping to ease the affordability crunch. However with so many other global forces at play putting upward pressure on the cost of everything (rising costs of goods and labour due to an aging population, global warming and geopolitics disrupting supply, and continued demand from an increasingly “wealthy” global population) it’s unlikely that ultra-low interest rates will return anytime soon. As long as supply doesn’t fall off a cliff, this should result in a more modest annual growth rate for housing prices than we’ve seen in the last 15 years.

More people will rent

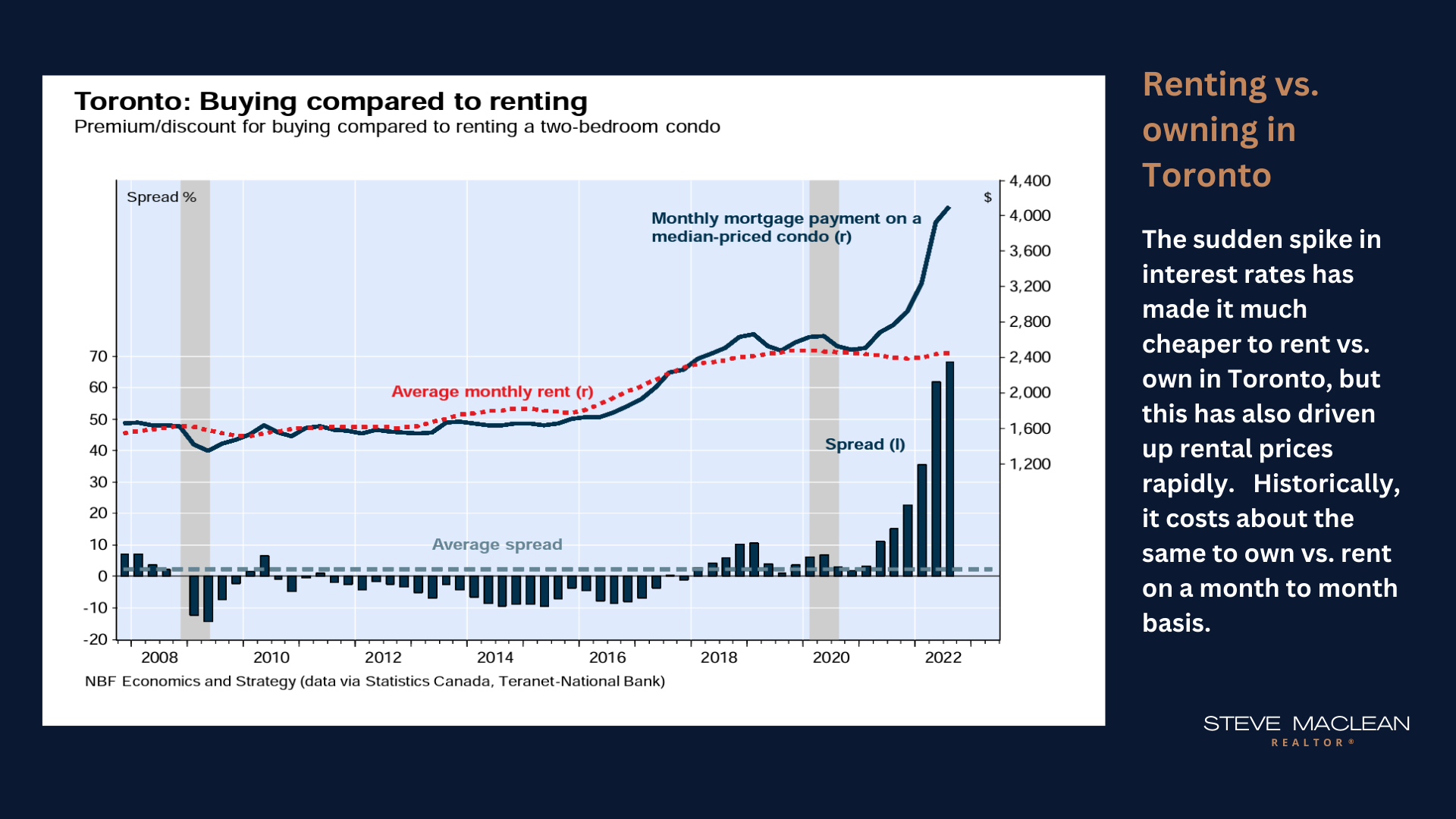

Another side effect of worsening affordability is that more and more people will choose to rent. It’s currently cheaper to rent vs. purchase (on a monthly cost basis). But historically, it’s been about the same cost and this has been a driving force for people wanting to get into the housing market as owners (why rent when you can own and build equity!). However in order to own you need to save up for a downpayment, and this is becoming increasingly difficult as home prices increase.

Owners will continue to build significant wealth across all asset classes

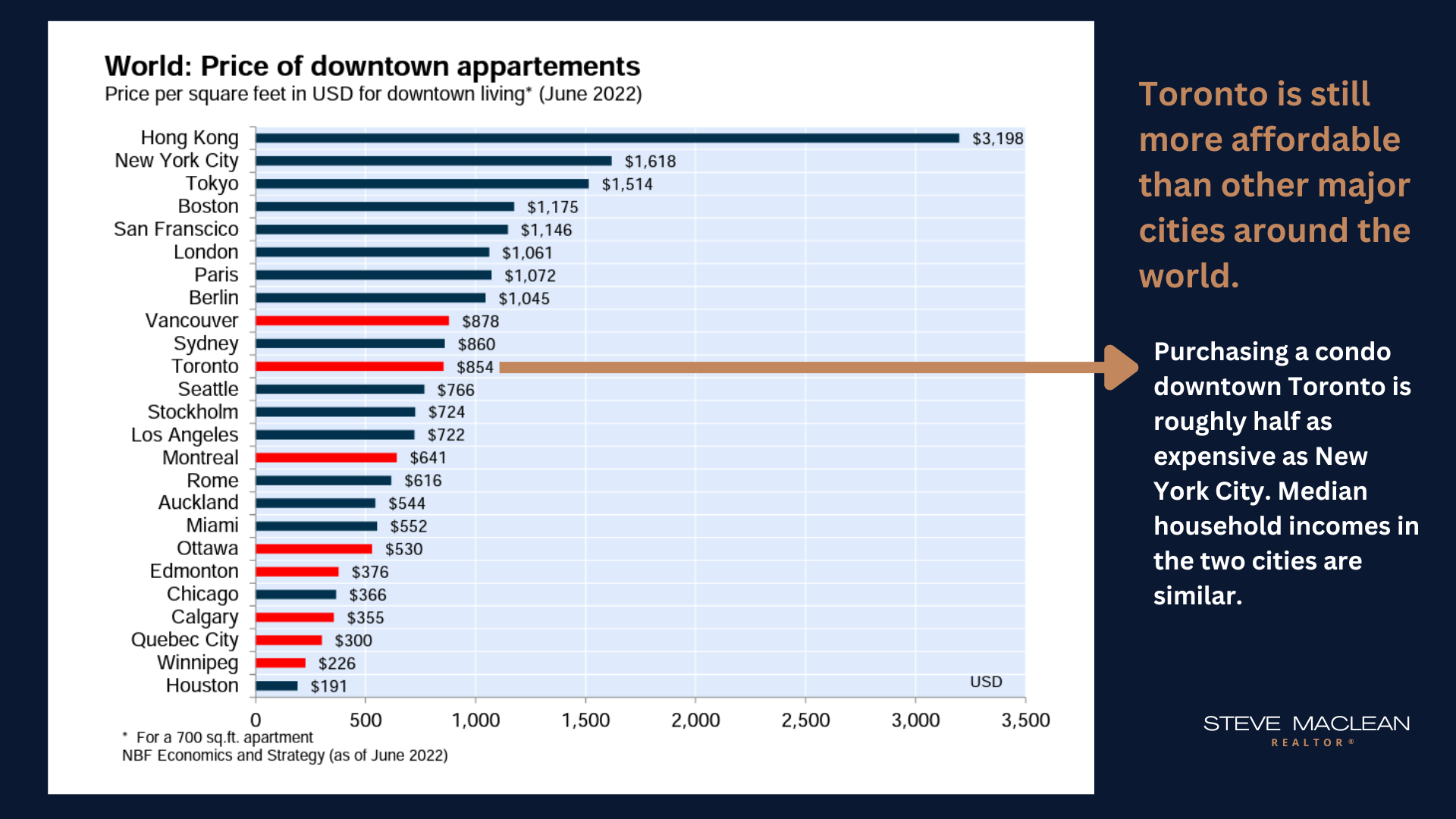

Yes, everything I’ve laid out so far does not provide much optimism if you’re trying to save for a downpayment and your wages haven’t gone up by 300% in the last 15 years to keep up with housing prices. BUT, this is the reality we are living in and this will continue to be, at least to some degree, the reality of the future. And just to put everything in perspective on a global scale, check out the chart below.

We’re only about halfway up the chart in terms of price per square foot vs. some other major cities in the world. This chart does not factor in any measure for affordability (IE median household income in that city vs. cost to purchase in that city) but the more sought-after Canada and the GTA become to live or own real estate in, the higher Toronto will climb on this chart. And I have no doubt that this will happen - Canada is rich in resources and democracy, and low on the risk of places that will become uninhabitable due to climate change; we’re extremely well positioned compared to many other places on earth and we have recently been welcoming record numbers of immigrants.

So what’s the conclusion? We’re currently experiencing a moment in time where affordability is at an all time low, but this will inevitably fluctuate as it always has. Through a combination of changes in interest rates, incomes, and supply of housing there is a path back to better affordability. If you want to have control over your housing (IE not be at the mercy of a landlord) capitalize on the bright future prospects of the GTA and build meaningful wealth over the coming decades, owning real estate in the GTA (and frankly many other places in Canada) is a sure path forward. Painful as it may be, if ownership is a priority for you and it’s within reach financially, keep saving for that downpayment and trust that the long-term trends are heavily in your favour.

-Steve